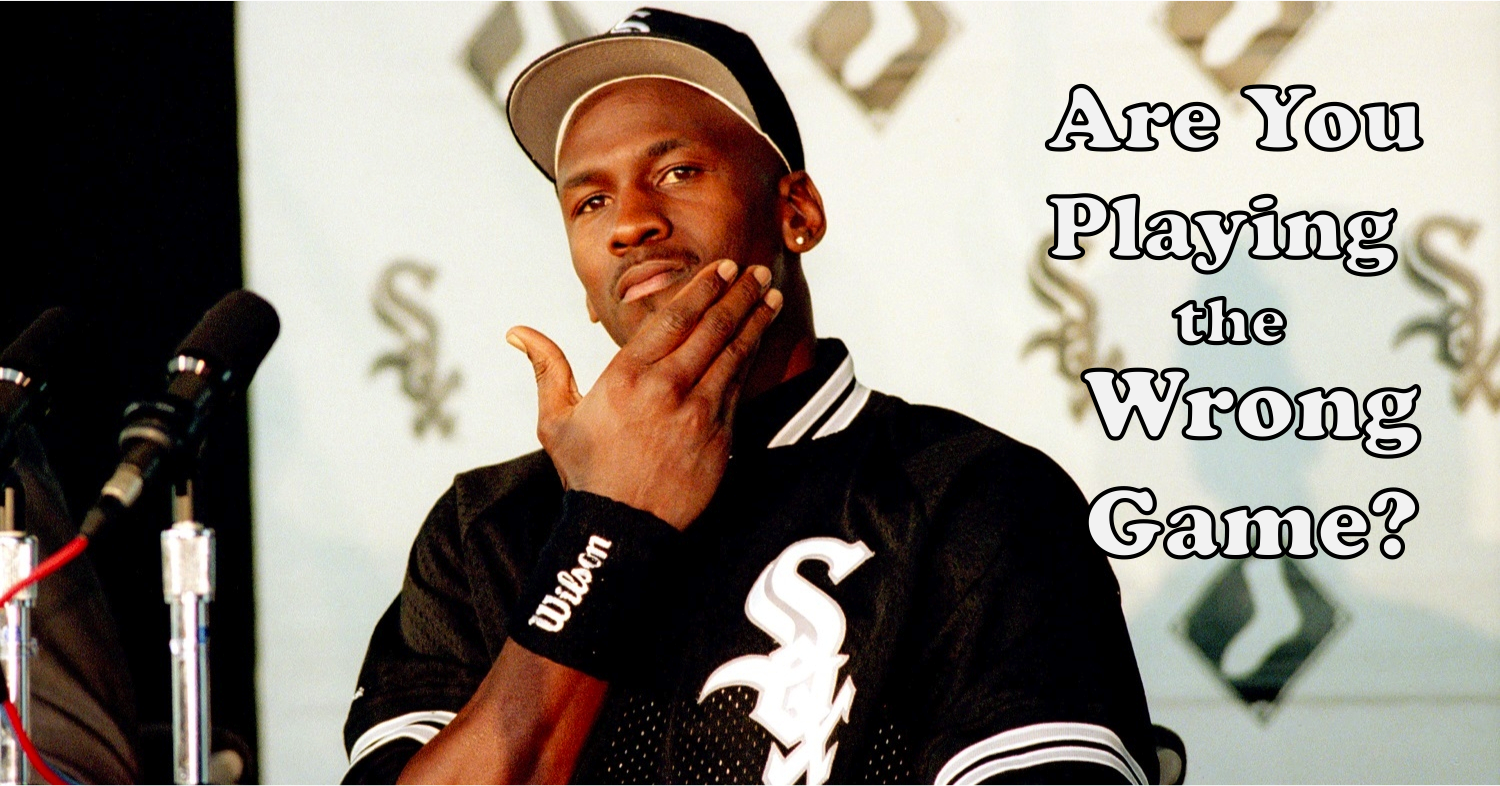

You didn’t invent Uber. Here’s why, and how you can invent the next one.

It all seems so obvious now.

You’ve been in cabs before. You hate them. You have a mobile phone. You use it a lot. You use apps. You enjoy using them.

Why not use the apps you love on the phone to stare at all day to solve the awful experience of catching a cab?

Aha!

The only problem is, someone beat you to it and created a billion dollar company by basically turning every car on the planet into a taxi.

Brilliant.

Now, we’ve all had the dreaded “Why didn’t I think of that?” moment and it can be easy to agonize over not connecting the dots on a puzzle that seems so easy to solve in retrospect.

But as they say, there’s no use crying over spilled Moet.

A much better use of your time would be to put yourself in position to come up with great ideas in the future.

See, the reason you didn’t invent Uber (or insert other company that applies to your WDITOT moment) isn’t because you don’t have the ability to come up with great ideas.

You do!

It’s because you don’t have a deliberate process for generating ideas and putting them into action.

Now for the good news!

The good thing for you is that it’s pretty easy to start being deliberate about developing new ideas. The added benefit is that when you start generating lots of ideas you take the pressure off of yourself to come up with the “One Big Idea” that most people think will just suddenly pop into their heads one day.

How to Come Up With Better Ideas

Here’s my simple 4 step process for getting better at creating ideas and putting them into action.

1. Be hyper curious & aware

You have to notice things that most people don’t notice. And don’t just notice them, get in the habit of asking yourself “What if…” or “How could I make this better?”

2. Stop waiting around for “The Big Idea” to drop into your lap

The “Aha Moment” sounds great interviews but people rarely stumble upon great ideas.

3. Document your ideas and set aside time to evaluate them

Write down or put your ideas in your phone the moment you have them. Then set aside specify time during the week to think critically about those ideas, evaluate them and decide which ones you want to move forward on.

4. Find someone you can trust to discuss your ideas with

Now, the Winklevoss twins might not agree with this tip, but the mere act of communicating your idea with someone else can help make the idea clearer in your own mind and might help you get closer to making it a reality.

Jason was the very first guest on the Movers & Shakers Podcast, and we were lucky to have him. He dropped tons of knowledge in that episode, and now he’s taken it a step further by releasing first book, Creativity for Sale.

Jason was the very first guest on the Movers & Shakers Podcast, and we were lucky to have him. He dropped tons of knowledge in that episode, and now he’s taken it a step further by releasing first book, Creativity for Sale.

You have an idea. You’ve built a community of people who like what you have to say. Now it’s time to sell your product.

You have an idea. You’ve built a community of people who like what you have to say. Now it’s time to sell your product.