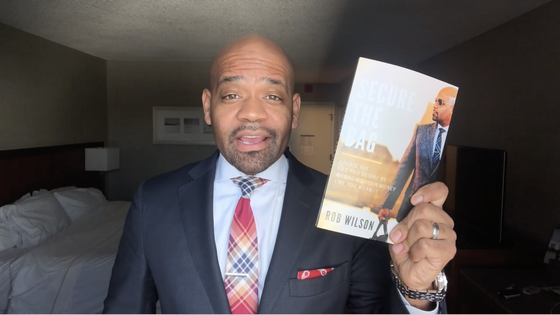

I wrote a book! (seriously!) I promise you, it’s not an April Fool’s joke! I sat down and wrote an actual book because I feel that the topic is so important. I mean, have you ever seen the show The Walking Dead? Have you noticed how the zombies just wander around aimlessely with no destination in mind (they [...]