I wrote a book! (seriously!)

I promise you, it’s not an April Fool’s joke! I sat down and wrote an actual book because I feel that the topic is so important.

I mean, have you ever seen the show The Walking Dead? Have you noticed how the zombies just wander around aimlessely with no destination in mind (they are deal after all) and how they get thrown off their path very easily?

Well, I’ve seen may people do just that, but in real life. I call them the walking broke. They have no idea what they’re trying to accomplish, financially. They have no clue on how much money they need to save in order to have a comfortable retirement.

A lot of them don’t even know where the 401k from their old job is, or how much money is in it!

Any of those things sound familiar?

Look, it’s time to put an end to that type of financial management.

You are solely responsible for your own financial wellbeing and that of your family.

It’s time that you started acting like it.

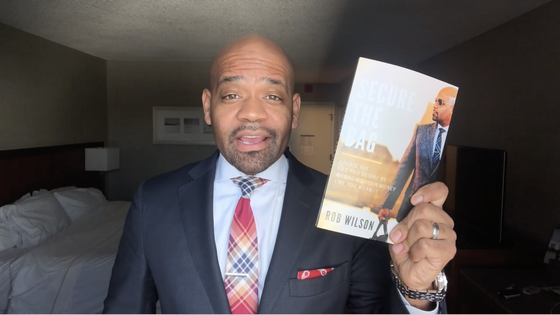

If you agree with me, then you’re in luck, because that’s exactly why I wrote Secure the Bag: Create the life you desire by managing your money like you mean it.

I want to help you take responsibilty for building the kind of wealth that you and your family deserve. In the book, I show you how to do it, step by step.

Let’s Discuss!

It doesn’t matter whether you’re making six figures, but don’t have much to show for it just yet, or if you’re trying to climb out from underneath a mountain of student debt. I’ve got strategies and techniques that will help you if you’re in either situation…or both.

Ready to get serious about your money? Go ahead and grab your copy here.

Make today the day that you stop saying what you’re “going to do” and start doing it.

It’s time to Secure the Bag.

Let’s get to work.

Hip Hop Generation — a term customarily applied to blacks born after the civil rights movement that has, in some cases, broadened to include anyone 18-35 who grew up on hip-hop music and culture. President-Elect Barack Obama understood the significance of targeting this generation for their vote, and like Obama, Financial Advisor Robert Wilson is also focused on building his practice with the young hip hop entertainers, rappers, and athletes.

Hip Hop Generation — a term customarily applied to blacks born after the civil rights movement that has, in some cases, broadened to include anyone 18-35 who grew up on hip-hop music and culture. President-Elect Barack Obama understood the significance of targeting this generation for their vote, and like Obama, Financial Advisor Robert Wilson is also focused on building his practice with the young hip hop entertainers, rappers, and athletes. Okay folks, step into my office, I’m glad you’re here. I’ve been meaning to have this discussion with you.

Okay folks, step into my office, I’m glad you’re here. I’ve been meaning to have this discussion with you.