You know that idea in your head? The one that you’ve had for a few years now? Yes, the one you tinker with every now and then on nights and weekends until other things in your life push it to the backburner. Yeah, that one. It’s brilliant. There’s only one problem, no one knows about it because you’re afraid to put it out there. Let’s chat, I think I know why.

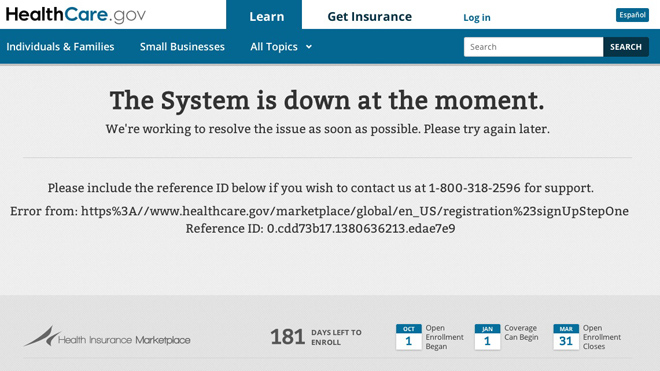

Let’s take the rollout of the Obamacare website for example. I know this is a high profile example, but stick with me for a moment. Whether you agree with the law or not (this is not a political blog), let’s just except the premise that the President and everyone else that voted for the Affordable Care Act are looking to do something significant with health care in the United States.

In fact the ACA is the most significant overhaul of health care in this country since the passage of Medicare and Medicaid in 1965! I’d call that a huge undertaking.

Whenever you are trying to make a big dream come true there are bound to be bumps in the road. The Obamacare website rollout is a great example of this. The site has been plagued in the early going by connectivity and other technical issues. So much so that the website itself has prompted a few days of Congressional hearings on the subject!

However, if I was in the position of the POTUS or Kathleen Sebelius I would simply have offered one principle that would be politically unpopular (and that the media would have a field day with), but one that every serious entrepreneur or business person knows is absolutely vital to the successful deployment of their big ideas:

Done > Perfect

That’s right, your idea is far more valuable if you simply get a MVP out the door (tech speak for minimally viable product) so that you have a starting point to work from. You could always put off, delay, tweak, research, revise, alter, change or any number of things that only serve to validate your fear of making a mistake or things not working or looking exactly right the first time.

I’m always astonished by the number of people that haven’t started their business yet because they haven’t found the “perfect” name for their product or a great logo. Seriously?

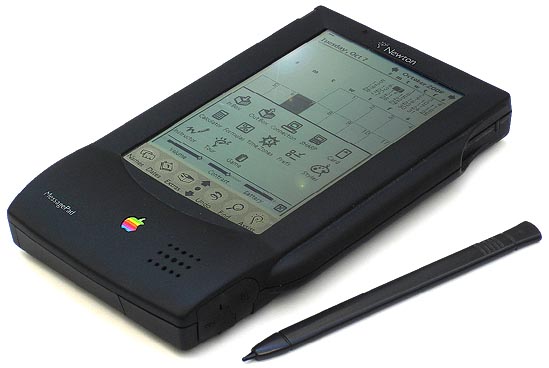

People like this think that Apple magically dreamed up the iPhone and iPad and went on to sell millions of units and make billions of dollars. However, these people either have short memories or aren’t students of business. They fail to remember the Apple Newton that was a colossal failure in the marketplace and what was supposed to be its killer feature, handwriting recognition, became the butt of jokes in newspapers around the country.

But let me ask you something, who do you think had the last laugh?

I know that it’s extremely uncomfortable for you to put yourself in the position of being publicly sconred like Katherine Sebelius just for trying to bring something of value to the world. It hurts even worse when the resistance to your ideas is coming from people whose opinion you care about.

But I’ve got two little words that will help you blow the lid off of any negative feedback you’re getting about putting your idea out there:

“Beta Test”

My first job after completing my Industrial Engineering degree at the University of Pittsburgh was as a technology consultant at Deloitte Consulting, one of the largest professional services firms in the world. I participated on a number of information technology projects for large organizations, and it was there that I learned the value of the beta test.

A beta test occurs when you’ve tested your product internally and you release it to a (usually limited) number of end users so that the product can function in the real world and you can continue to make improvements. Do you use Gmail? Google released its popular email product in 2004 and it remained in “beta test” phase for 5 whole years, even though it racked up more than 100 million accounts during that time.

Google is the second most valuable technology company on the planet, right behind the aforementioned Apple. I think it would be ok to learn from them.

So, if you take the idea that you’ve been trying to get out of your head, get it to a point where it’s functional and release a “beta version” to the world, you not only put yourself in a position to help people and begin to reap the benefits of your hard work, you also put the smack-down on any resistance because the “beta” label acknowledges that, while the product should work as intended, you are still working to improve your product.

The Administration would have done itself a favor if it had released the product in “beta” and/or conducted a phased rollout, as I would have advised them if they were my client. But who knows, perhaps $174 million doesn’t get you as much quality consulting as it used to (I really should have upped my rates).

I mean, health care hasn’t changed for the better in 50 years. You don’t think people can wait two months for kinks to be worked out in the system?

Do Yourself a Favor

Do yourself a favor and stop waiting for the perfect time, logo, name, website, wordpress theme, customer, partner, mascot or whatever else has been holding you back. Those things will come in time. Get over your fear of not having a blockbuster right out of the gate. Reid Hoffman, founder of LinkedIn famously said, “If you’re not somewhat embarrassed by your 1.0 product launch, then you’ve released too late.” There’s value in launching early, getting engaged with customers, and learning from them. That can direct your progress.

Oh, and please don’t try to weasel out of this method by saying that you’re not working on a software or internet product. It doesn’t matter if you are becoming a plumber or you are designing t-shirts. Put something out there slap “beta” or “version 1.0″ on it and keep moving. Said another way:

“You don’t have to be GREAT to get STARTED, but you do have to START in order to be GREAT” – Les Brown

So it’s time for you to get started. I can’t wait to see what you have up your sleeve.

Photo courtesy

Photo courtesy