BECKHAM MEDIA GOES ONE ON ONE WITH ROBERT WILSON FINANCIAL ADVISOR TO THE HIP HOP GENERATION

Hip Hop Generation — a term customarily applied to blacks born after the civil rights movement that has, in some cases, broadened to include anyone 18-35 who grew up on hip-hop music and culture. President-Elect Barack Obama understood the significance of targeting this generation for their vote, and like Obama, Financial Advisor Robert Wilson is also focused on building his practice with the young hip hop entertainers, rappers, and athletes.

Hip Hop Generation — a term customarily applied to blacks born after the civil rights movement that has, in some cases, broadened to include anyone 18-35 who grew up on hip-hop music and culture. President-Elect Barack Obama understood the significance of targeting this generation for their vote, and like Obama, Financial Advisor Robert Wilson is also focused on building his practice with the young hip hop entertainers, rappers, and athletes.

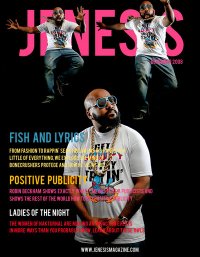

Internationally acclaimed financial expert Suze Orman may be recognized worldwide, but Robert Wilson is cleverly carving a niche in the financial industry by providing financial advice to the Hip Hoppers because he says they comfortably spend their money on 200 dollars sneakers, sporting their high priced bling-bling and other expensive items, but need help when it comes to being financially savvy. Wilson says he wants this generation to start building wealth and is advising many of his clients to start investing and saving.

Wilson also shares his thoughts about the current market conditions post election and strongly advises the public to not hide their money under the mattress because of the volatile market.

Beckham Media: Now that Obama has won the election, do you think there will be some stability in the markets?

Rob Wilson: The turmoil in the markets isn’t simply a function of who is in the oval office, so I think there will continue to be volatility in the markets for some time.The markets will be looking for some direction from the President-elect on how he intends to combat the problems in the economy and in the financial markets. Clarity on those points could provide some stability, but ultimately it will be the plans that have already been put in place in addition to any that the new administration might adopt that will hopefully strengthen the markets and the economy.

Five Things You Must Learn From the World’s Biggest Job Interview

Five Things You Must Learn From the World’s Biggest Job Interview Wow! It all seems so surreal. It’s kind of like watching a bad (or any) episode of Flavor of Love; we’re just waiting for the next train wreck to happen. But unfortunately it’s not a dream, it is the living drama that is the Nightmare on Wall Street, 2008 edition.

Wow! It all seems so surreal. It’s kind of like watching a bad (or any) episode of Flavor of Love; we’re just waiting for the next train wreck to happen. But unfortunately it’s not a dream, it is the living drama that is the Nightmare on Wall Street, 2008 edition. Okay folks, step into my office, I’m glad you’re here. I’ve been meaning to have this discussion with you.

Okay folks, step into my office, I’m glad you’re here. I’ve been meaning to have this discussion with you.