Never trust a big butt and a smile – Bell, Biv, Devoe

Once again the timeless advice of our favorite R&B acts of yesteryear has proven its truthfulness.

Look, athletes and entertainers are targets. Young ones. Old ones. Middle aged ones. It doesn’t matter. If you’re good at sports at any level, believe me, there is someone in the shadows waiting to take advantage of you one way or another.

In today’s example, look no further than former 2nd overall pick in the 2011 NBA Draft, and current forward for the NY Knicks, Derrick Williams. In a bizarre but predictable weekend event, Mr. Williams was robbed of $750,000 (!) in jewelry after befriending two women at a club and taking them back to his place.

Now, he’s obviously a target because he’s a young, highly paid athlete in one of the largest sports markets in the world. This we already know.

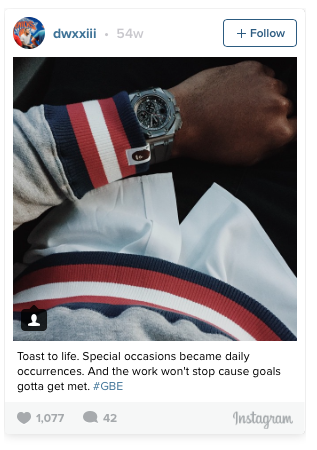

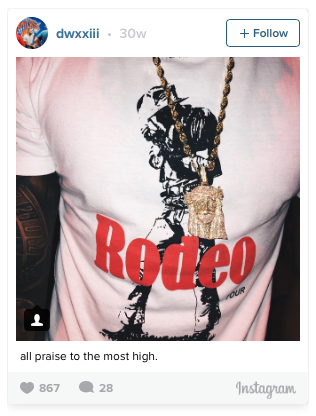

Yet, he absolutely did himself no favors by consistently posting pictures on Instagram of himself with his prized possessions:

That just shows you the gift and the curse of social media. Fans can get to know you and admire your success. Thieves can follow your moves and plot against you. Until something happens, you can never really be sure who’s who.

Certainly, one could question the wisdom of taking two young women whom you just met, back to the place that you call home. For many, many reasons this could have ended up bad, but we’ll save that discussion for another day.

Sure, it would be reasonable to question the necessity of owning $750,000 in jewelry. However, perhaps the other areas of his financial life are secure and he chooses to spend his discretionary funds on jewelry. Cool, do your thing.

What’s unacceptable, though, is to have that amount of money in expensive possessions stored in a place where they could easily be taken, particularly if you are going to have unfamiliar individuals running around your house. To be clear, a Louis Vuitton jewelry case in the back of a closet isn’t a secure location.

So students, class is in session; please take notes. Here’s my advice on making sure you are not the next victim of the bling ring:

1) Avoid all of the shameless social media posts specifically addressing your material items. Unless you’re getting paid for the “commercial,” you’re promoting someone else’s product for free and giving everyone else a reason to hate you. Not everyone is happy because you’re “winning.”

2) Make sure you have digital copies of the appraisals for all of your jewelry stored somewhere in the cloud.

3) Buy enough insurance to make sure that all of your items are covered. Don’t assume that your homeowners or renter’s insurance will cover the full amount of your holdings.

4) If you’re going to purchase a significant amount of jewelry, for goodness sake buy a safe with a combination that only you know and anchor it to the floor. It’s not that hard. You can purchase a perfectly good one on Amazon and it will be to you in two days with Amazon Prime.

5) Don’t get lulled into a false sense of security by a pretty face and a short skirt at the club. When in doubt, please refer to Bell Biv Devoe above.

6) Lest you think I’m only talking about women seeing you as a target, you must understand that men see you as a target too. But instead of a skirt, they’ll have on suits and call themselves, agents, financial advisors, attorneys, car dealers, jewelers, casino builders, movie producers and so on. You must always have your guard up with them as well. As Mark Jackson would say, “Hand down, man down.”

I get it. Athletes like jewelry. It’s a thing. Especially in your 20s.

However, you must at least treat your jewels, your cash and your hard work with some respect. Seriously.

Whomever decides to steal your jewels (most likely) weren’t with you shooting in the gym.

I’m sure you didn’t put in all of those hours getting to the top level of your profession just to allow someone to take advantage of you.

So your lesson for today is keep your guard up, secure your stuff and listen to 90s R&B. There’s tons of valuable nuggets of wisdom there.

Rob Wilson is a celebrity financial advisor with a practice geared towards professional athletes and entertainers. He’s also a frequent contributor the CNN, CBS, NBC and various other media outlets.

For more financial advice, be sure to subscribe here: https://robwilson.tv/vip